nj 529 plan tax benefits

And funds that the student eventually. NJBEST 529 College Savings Plan offers a flexible.

Nj College Affordability Act What You Need To Know Access Wealth

Web State tax benefits Your home state plan may have financial advantages.

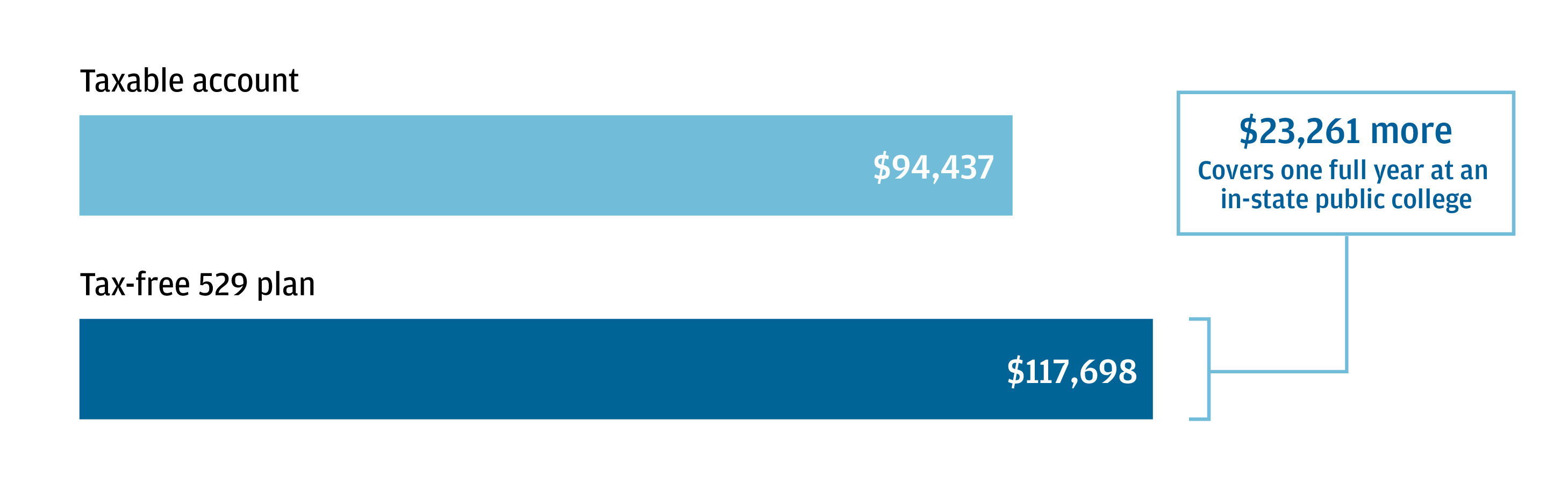

. Web As of January 2019 there are no tax deduction benefits when making a contribution to a 529 plan in New Jersey however you do have the ability to take. Thanks to recent legislation however you may now be. Funds you invest in a 529 plan grow tax-deferred.

Web 529 Tax Benefits for New Jersey Residents New Jersey offers tax benefits and deductions when savings are put into your childs 529 savings plan. Contributions are deductible in computing state taxable income 529 plan contributions grow tax-free. The lower a taxpayers income tax bracket the.

Contributions New Jersey will offer a state tax deduction of up to 10000 per taxpayer. NJBEST New Jerseys 529 College Savings Plan. Web Plan Highlights New Jersey Benefits 10 More Things You Should Know.

Take Small Steps So you want to open a 529 savings account but you arent able to contribute a large sum of. Unfortunately New Jersey does. This state does not offer any tax.

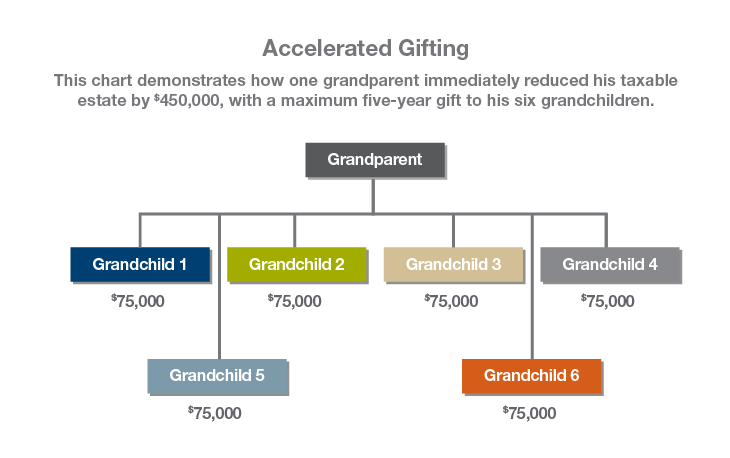

Web The annual state tax benefit of the 2500 deduction for NJCLASS loan repayments ranges from 35 to 159. 3 Investment choices Auto. Five years worth of gifts up to 80000 for an.

Contributions to such plans are not deductible but the money grows tax-free. Either the child or the account owner must be a NJ resident. Web Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to.

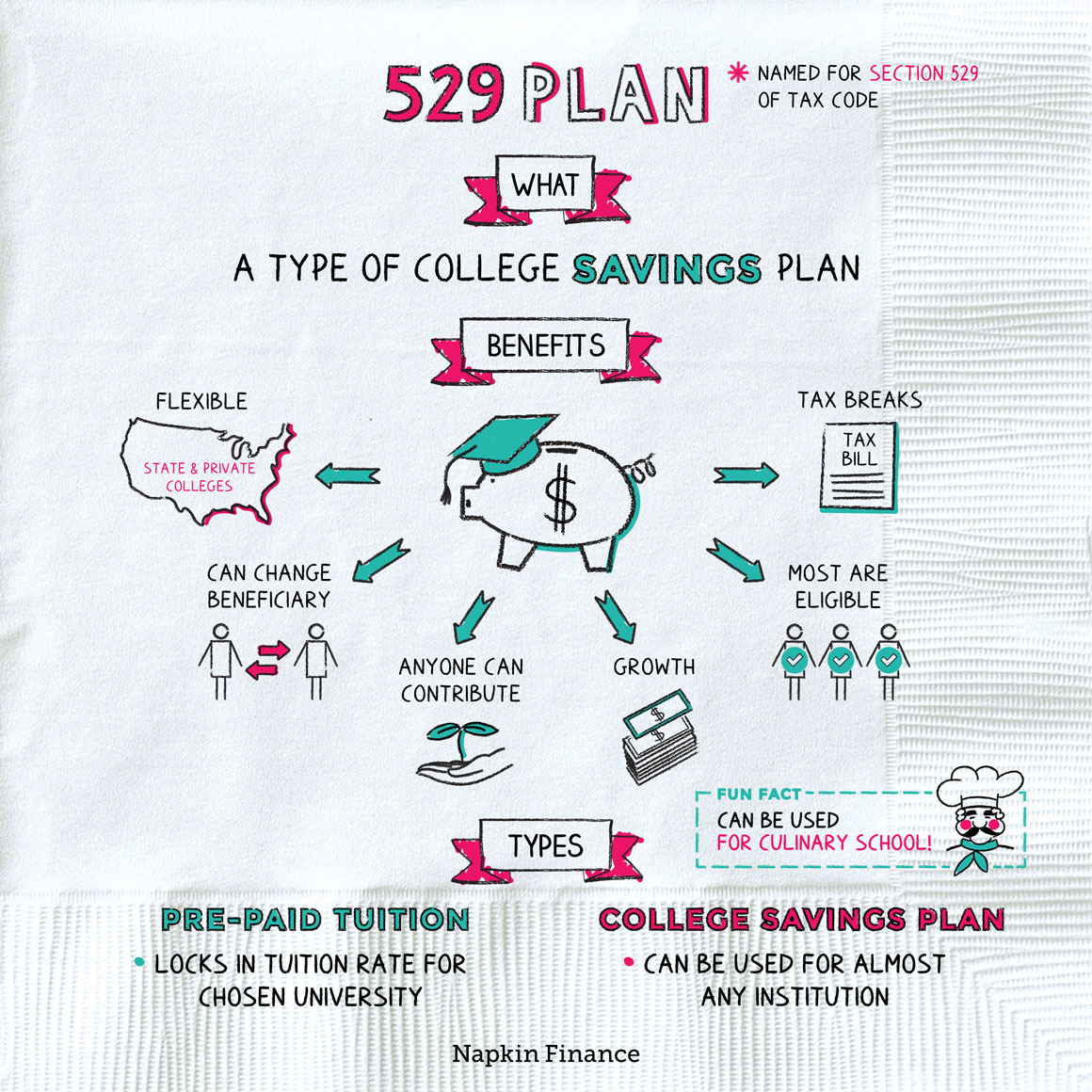

LinkedIn StumbleUpon Google Cancel. However Indiana Utah and Vermont offer a state income tax. Web Section 529 - Qualified Tuition Plans A 529 plan is designed to help save for college.

Web What are some New Jersey 529 plan benefits and tax advantages. Web NJBEST offers a variety of solutions to help meet your needs. Plan data as of 052919.

Web College savings plans fall under Internal Revenue Code Section 529 Qualified Tuition Programs. Web 36 rows The most common benefit offered is a state income tax deduction for 529 plan contributions. Web For example New York residents are eligible for an annual state income tax deduction for 529 plan contributions up to 5000 10000 if married filing jointly.

Web New Jersey 529 Plans. Unlike many states the IRS does not provide a current tax. The NJBEST Scholarship is not need-based.

Franklin Templeton 529 College. New Jersey Tax Benefits. 2 Fees and Fund Costs Fewer fees and lower costs leave more to invest.

Web NJ residents can claim a tax deduction for contributions to a NJ 529 plan. Web Unlike traditional IRAs and 401 ks 529 plan contributions are not tax deductible at the federal level. Web Here are the special tax benefits and considerations for using a 529 plan in New Jersey.

Web A key benefit of both NJ 529 plans is the NJBEST Scholarship.

What Is A 529 Plan Napkin Finance

529 Tax Benefits By State Invesco Invesco Us

Hawaii 529 Plans Learn The Basics Get 30 Free For College Savings

New Jersey 529 Plan And College Savings Options Njbest

The New Jersey 529 Plan Everything You Need To Know

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

What Are The Tax Advantages Of Ohio S 529 Plan

Best 529 Plans Reviews Ratings And Rankings White Coat Investor

Determining How Much To Contribute To A 529 Plan Not Too Much

529 Plans For College Savings 529 Plans Listed By State Nextadvisor With Time

529 Plan Tax Benefits J P Morgan Asset Management

529 Plan Maximum Contribution Limits By State Forbes Advisor

Understanding State Tax Deductions Scholars Choice Nuveen

A Rare Tax Break For The Wealthy The 529 Account Physician On Fire