vermont state tax withholding

If the Amount of Taxable Income Is. The Amount of Vermont Tax Withholding Should Be.

Withholdings And Estimated Tax Payments For 2021 2022 How They Work And When To Pay Them Wsj

The Amount of Vermont Tax Withholding Should Be.

. Over 0 but not over 2650. Kingdom Life Church Maine. The income tax withholding formula on supplemental wages for the State of Vermont includes the following changes.

Subtract the nontaxable biweekly Federal Health Benefits Plan payments includes dental and vision insurance program and flexible spending account - health care and dependent care deductions from the amount computed in. If the Amount of Taxable Income Is. The amount of the tax is 25 of the gross sale price eg with a contract sale price of 25000000 the withholding tax is 625000.

Office of the State Treasurer 109 State Street Montpelier Vermont 05609 Main Phone. Withholding Formula Vermont Effective 2020. Restaurants In Davis Ca Open Late.

Tax Withholding Table. Ashlynn Doyon at treasurersofficevermontgov. You can use the myVTax website to.

The annual amount per exemption has increased from 4050 to 4250. If the Amount of Taxable Income Is. Like the Federal Income Tax Vermonts income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

30 of federal withholding amount Noneligible rollover distributions Periodic payments. Vermont Eligible rollover distributions Periodic payments. An employee is paid 1800 each week.

Sherman Oaks Restaurants Open Late. For non-periodic payments the Vermont withholding can be estimated at 30 of the federal withholding. If Federal exemptions were used and there are additional withholdings proceed to step 8.

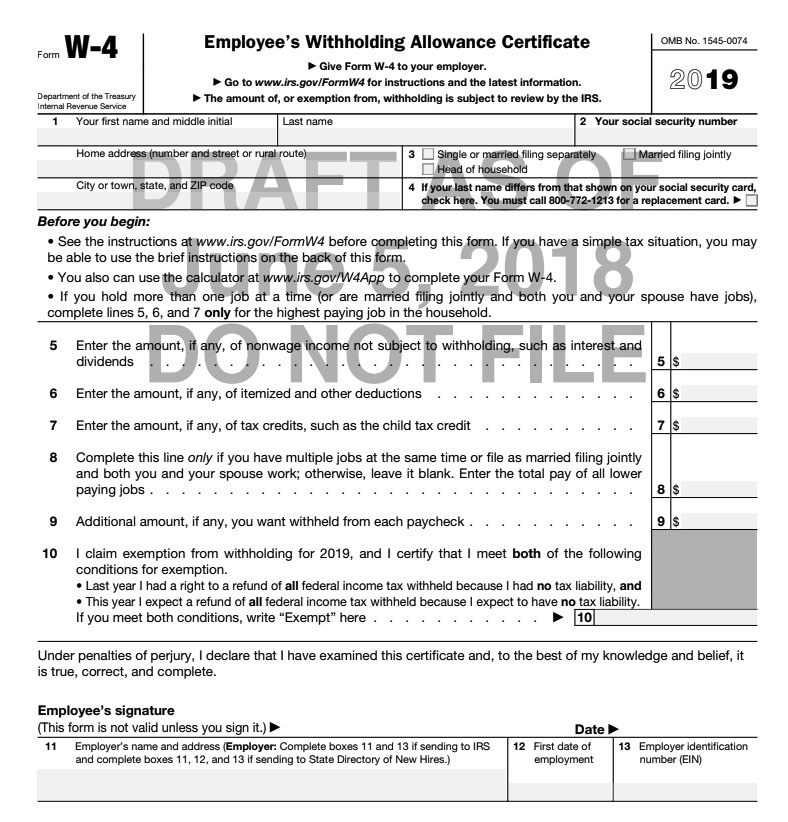

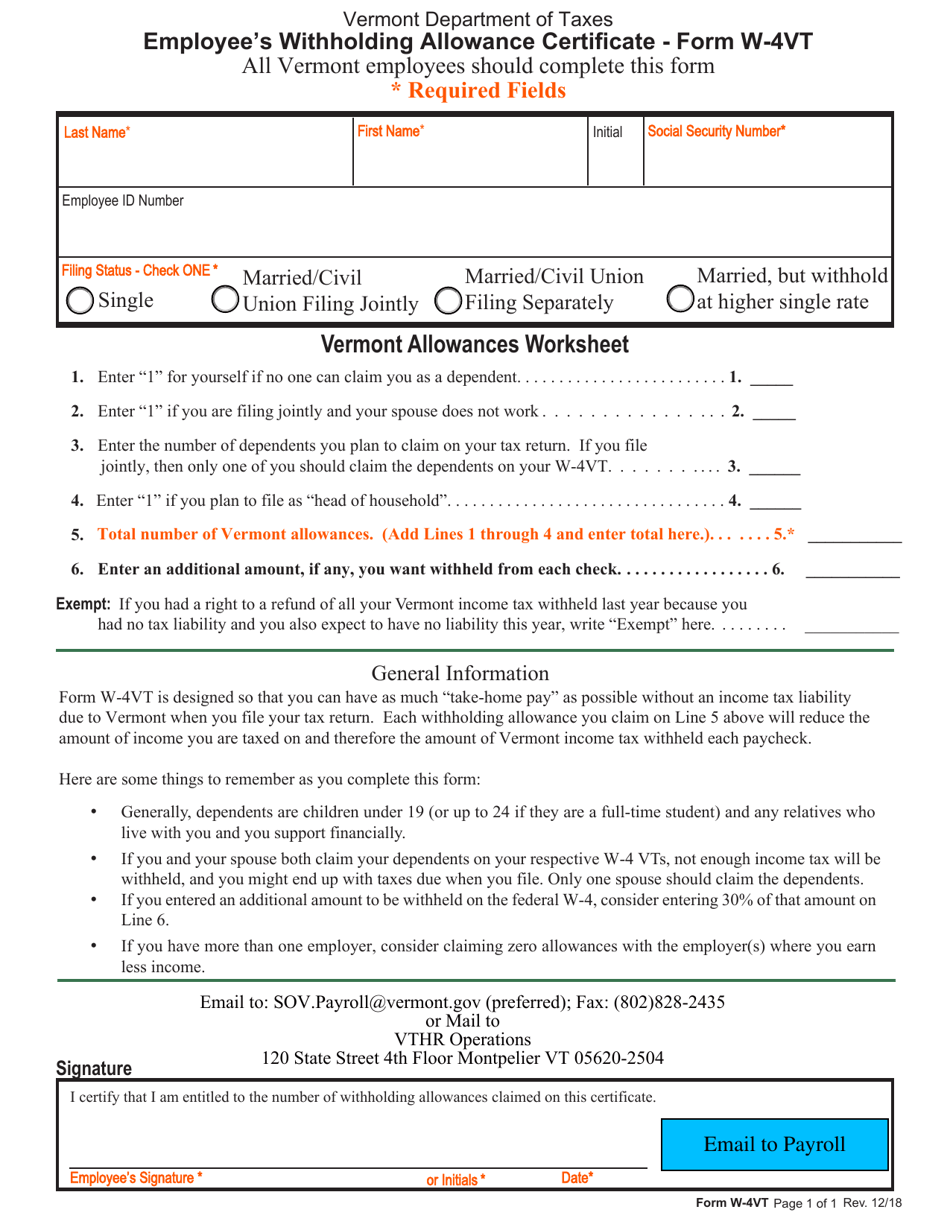

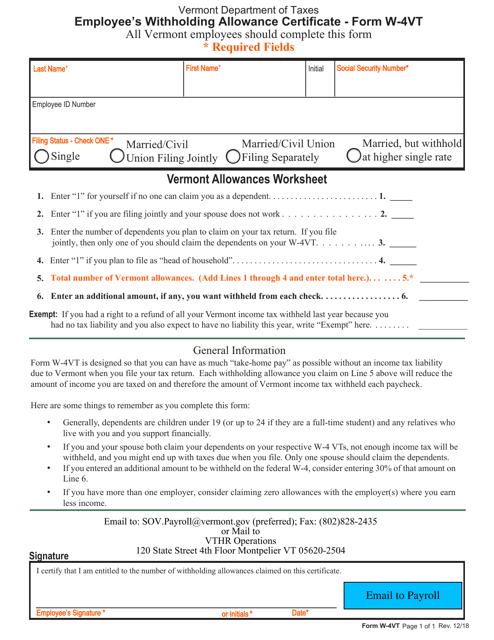

Shelter Island Restaurants Long Island. Her W-4VT form claims two withholding allowances and married status. State government websites often end in gov or mil.

The income tax withholding for the State of Vermont includes the following changes. The Single Head of Household and Married annual income tax withholding tables have changed. Subtract the nontaxable biweekly Thrift Savings Plan contribution from the gross biweekly wages.

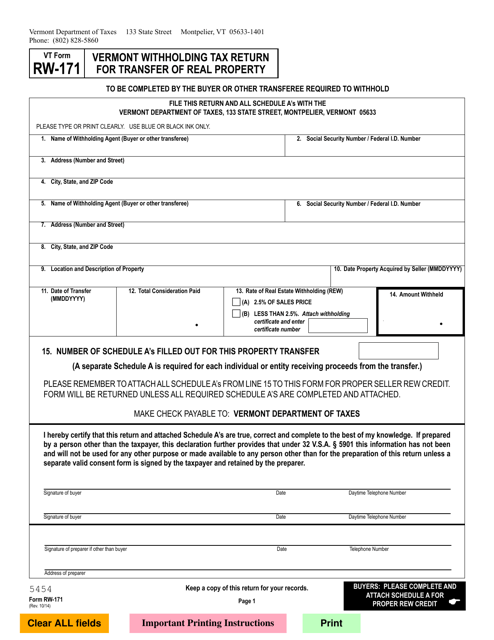

Vermonts tax system consists of a state personal income tax estate tax state sales tax local property tax local sales taxes and a number of additional excise taxes on products like gasoline and cigarettes. The income tax withholding for the State of Vermont includes the following changes. In Vermont sellers of real property who are not residents of the state are subject to a real estate withholding tax collected at the time of closing.

When you receive your payeither by direct deposit or paper. If you received Form 1099-G for unemployment compensation from the Vermont Department of Labor and have questions please review information on the Department of Labors website. Before sharing sensitive information make sure youre on a state government site.

Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding. 7 rows Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding. Vermonts maximum marginal income tax rate is the 1st highest in the United States ranking directly.

Single or Head of Household. 802 828-2301 Toll Free. No action on the part of the employee or the personnel office is necessary.

Vermont State Tax Withholding. The gov means its official. Vermont Income Tax Forms.

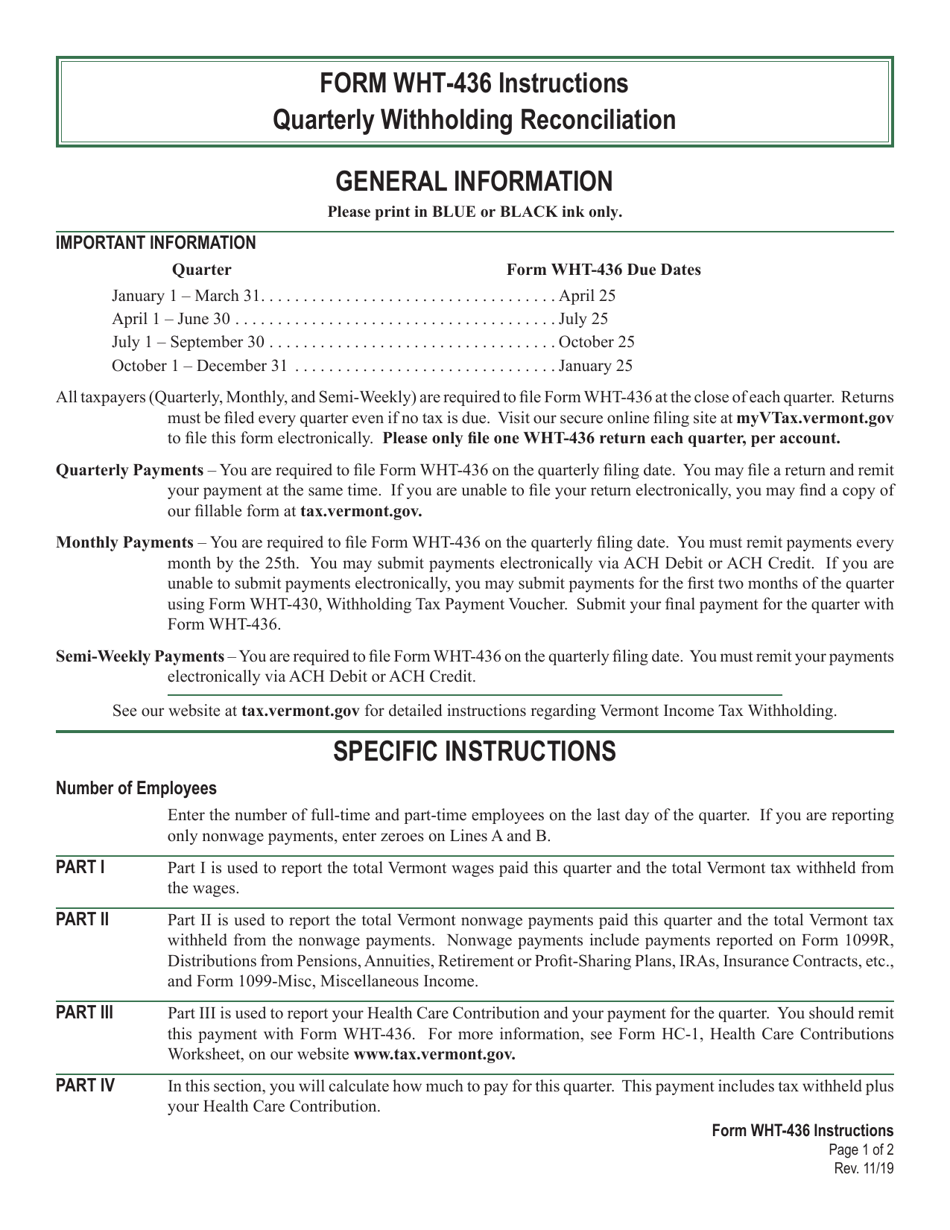

Vermont withholding is also required where the recipient elects optional federal withholding and does not specifically state that the payment is exempt from Vermont withholding. Reporting and Remitting Vermont Income Tax Withheld. The Amount of Vermont Tax Withholding Should Be.

The annual amount per exemption has increased from 4250 to 4350. The withholding is based on both the deferred payment and any income that may be derived from the deferred compensation. 30 of federal withholding amount No No Yes Yes.

2017 and 2018 Income Tax Withholding Instructions Tables and Charts. PUBLIC INFORMATION REQUESTS TO. Single or Head of Household Tax Withholding Table.

Single or Head of Household. The Single Head of Household and Married tax tables has changed. Vermont withholding is 50938392 x 00660 554 554 4539 5093 Because 162692 falls between 1543 and 3463 the tax is computed as 4539 plus 660 of the amount over 1543.

Specified by state wage tables Nonperiodic payments. 8 rows TAXES 21-10 Vermont State Income Tax Withholding. Plan the correct withholding rate is 6 of the deferred payment.

To help employers calculate and withhold the right amount of tax the IRS and the Vermont Department of Taxes issues guides each year that include withholding charts and tables. Tax Withholding Table. Vermont collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Tax Formula Withholding Formula Effective Pay Period 06 2017. If you pay wages or make payments to Vermont income. Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers.

Understand and comply with their state tax obligations. Click Here - For Public Records Database. No action on the part of the employee or the personnel office is necessary.

Once the employer has the information youve entered on forms W-4 and W-4VT the employer is able to calculate your withholding tax. B-2 Notice of Change. Apply the taxable income computed in step 5 to the following table s to determine the annual Vermont tax withholding.

On Schedule IN-112 Part I Line 7. Mi Tierra Restaurant Locations. For periodic payments the tax is computed using the Vermont wage charts or tables.

Specified by state wage tables Nonperiodic payments.

Vt Form W 4vt Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate Vermont Templateroller

State W 4 Form Detailed Withholding Forms By State Chart

Irs Form 945 How To Fill Out Irs Form 945 Gusto

How To Avoid The 30 Tax Withholding For Non Us Self Publishers Thinkmaverick My Personal Journey Through Psychology Books Technology Life Book Publishing

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Vt Form W 4vt Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate Vermont Templateroller

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

Paycheck Taxes Federal State Local Withholding H R Block

Download Instructions For Vt Form Wht 436 Quarterly Withholding Reconciliation And Health Care Contribution Pdf Templateroller

Vt Form Rw 171 Download Fillable Pdf Or Fill Online Vermont Withholding Tax Return For Transfer Of Real Property Vermont Templateroller

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

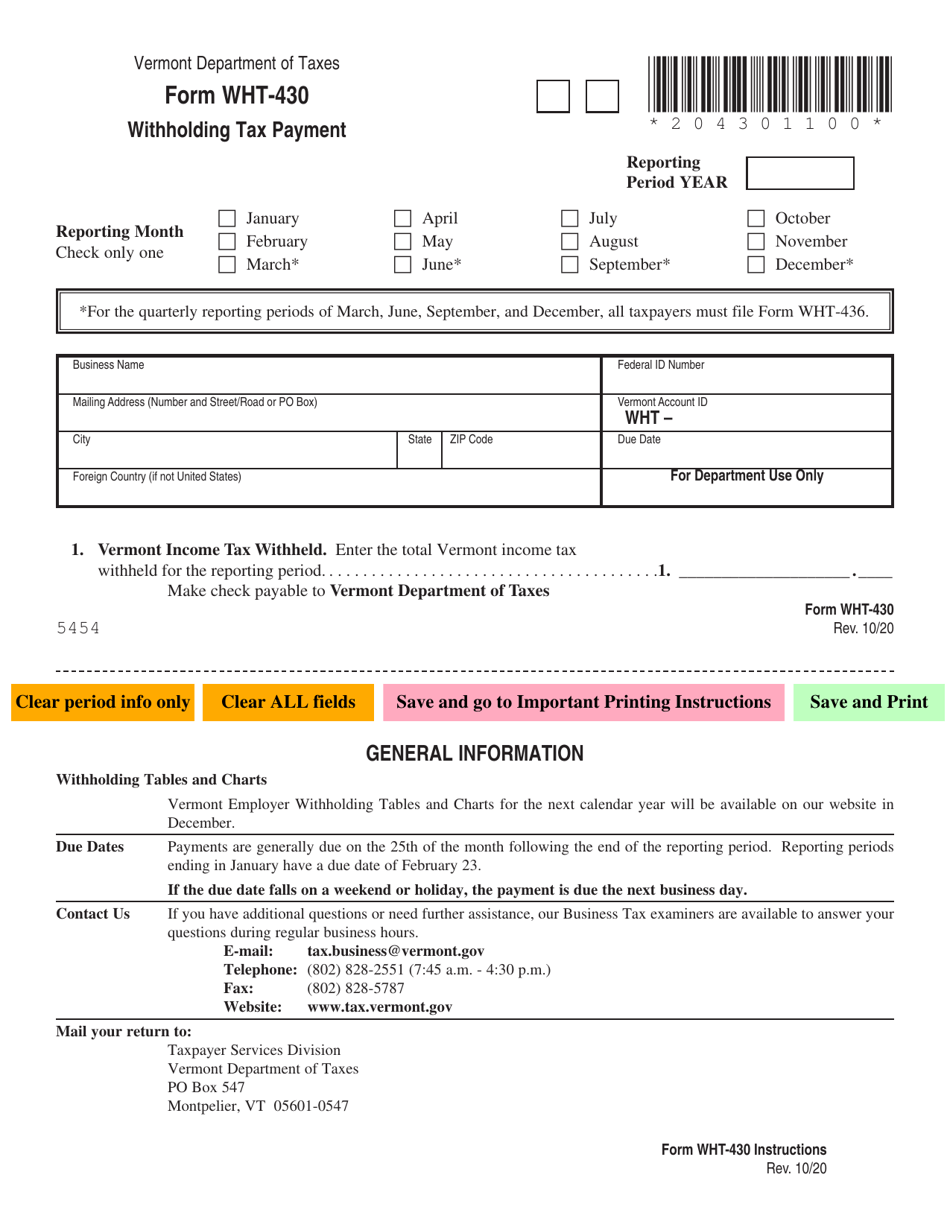

Vt Form Wht 430 Download Fillable Pdf Or Fill Online Withholding Tax Payment Vermont Templateroller

State W 4 Form Detailed Withholding Forms By State Chart

File Top Marginal State Income Tax Rate Svg Wikipedia

Tax Withholding For Pensions And Social Security Sensible Money